Taxes off paycheck

Knowing where you stand now with Social Security will pay off. Receive 20 off next years tax preparation if we fail to provide any of the 4 benefits included in our No Surprise Guarantee Upfront Transparent Pricing Transparent Process Free Audit Assistance and.

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

The deferred taxes were to be repaid by the end of 2021.

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

. For a weekly paycheck of under 21750 this means no wages could be garnished. Florida employers are responsible for withholding and paying the same federal payroll taxes as employers in the 49 other states. Instead of withholding FICA taxes from each paycheck business owners and independent contractors make quarterly self-employment tax payments.

It can also be used to help fill steps 3 and 4 of a W-4 form. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. Receive 20 off next years tax preparation if we fail to provide any of the 4 benefits included in our No Surprise Guarantee Upfront.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Which makes the deduction unavailable for donations made directly from your paycheck. For disposable earnings between 21750 and 290 any amount above 21750 would be garnished.

From fashion editorials to tax advice. Business Travel Expenses Deduction. Federal Tax Withholding Fed Tax FT or FWT.

The form assists employers to collect the proper amount of federal income taxes from your wages. Brands is a unique payroll service and HR firm that specializes in providing businesses like yours a low-cost and headache-free payroll and HR solution. In this case there will be no federal income taxes taken out of your paycheck.

However even in these situations other taxes may be due such as employer FICA taxes. However you can take pride in knowing youre making an important impact each week when you contribute to Social Security. See our article on how to update your QuickBooks payroll software.

If all taxes are calculated at 000 that may indicate an incorrect calculation. No worrieshere well lay out all the state and federal taxes and paycheck rules so you can process your Florida payroll quickly and enjoy the ocean breeze. March 23 2017 By Beth Kobliner Personal Finance Journalist New.

Aja has been quoted and. Heres a breakdown of the different paycheck taxes and why they sometimes change. Texas Paychecks and Taxes.

The comprehensive way to calculate payroll taxes include. With more than 45 years of expertise we are one of the premier payroll and HR leaders in the North East. If you had no federal tax withheld from your paycheck and need help navigating your taxes get help from HR Block.

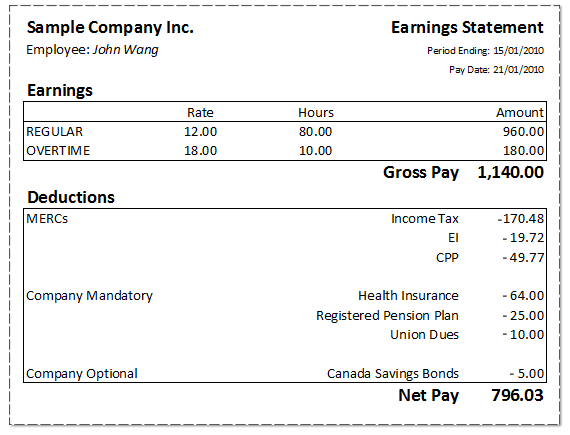

Gross Pay This is the amount youre paid before any taxes or deductions are taken out. The standard mileage deduction 56 cents per mile in 2021 and 585 cents per mile in 2022 is calculated by the IRS to include the average costs of gas car payments maintenance car. For weekly earnings of 290 or more a maximum of 25 percent could be garnished.

You pay self-employment tax based on 9235 of your. As a rule of thumb you should double check review and possibly update your W-4 whenever the follow happens. Reserve and National Guard members have a new way to pay off their remaining 2020 SOCIAL SECURITY TAX balance Per the Presidential memorandum issued on August 8 2020 the Social Security taxes of Reserve and National Guard members were deferred from September through December 2020.

Youd still get the big paycheck and youd be earning. On his days off you can find him at a basketball court or gym working up a sweat. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Texas.

Make sure you send both the taxes you withheld from the employees paycheck and the taxes you owe as the employer. With numerous tax filing options you can work in a way that best suits you. Carefulyou cant deduct both mileage and gas at the same time.

If you terminate or lay off an employee you must pay the employee their final paycheck within six calendar days or the next workday if the sixth day is on a day when the business. Now lets explore the various business expenses you might qualify to write off from your taxes next. These are contributions that you make before any taxes are withheld from your paycheck.

This calculator is intended for use by US. For contributions made into your account you can claim a tax deduction of up to 2700 every year. At first seeing taxes taken out of your paycheck can be a little disappointing.

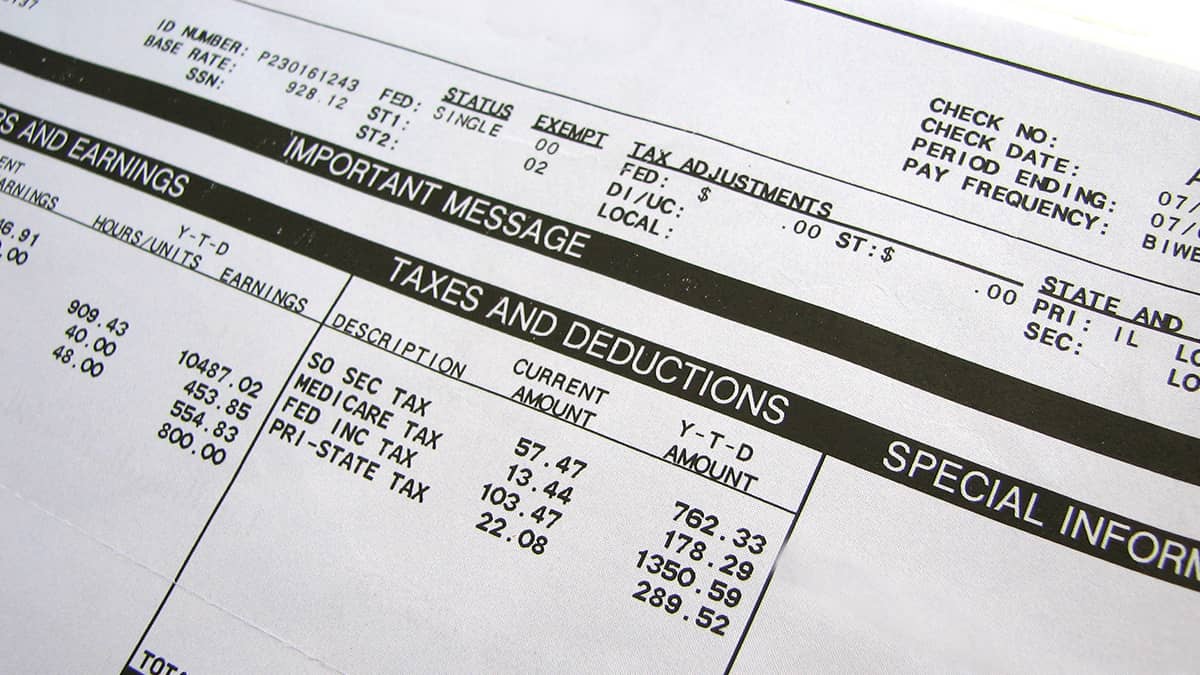

Everytime you start off at new job you should at least receive a W-4. Heres a list of items that appear on all paycheck stubs that you need to be familiar with. The first step to resolve an incorrect payroll tax calculation is to make sure you have the latest payroll update.

She writes from her experiences with money management and paying off 120000 in debt. Net Pay This is the amount youre paid after all applicable taxes and deductions are taken out from your gross pay. So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck.

How To Calculate Taxes Using A Paycheck Stub The Motley Fool

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Pay Stub Meaning What To Include On An Employee Pay Stub

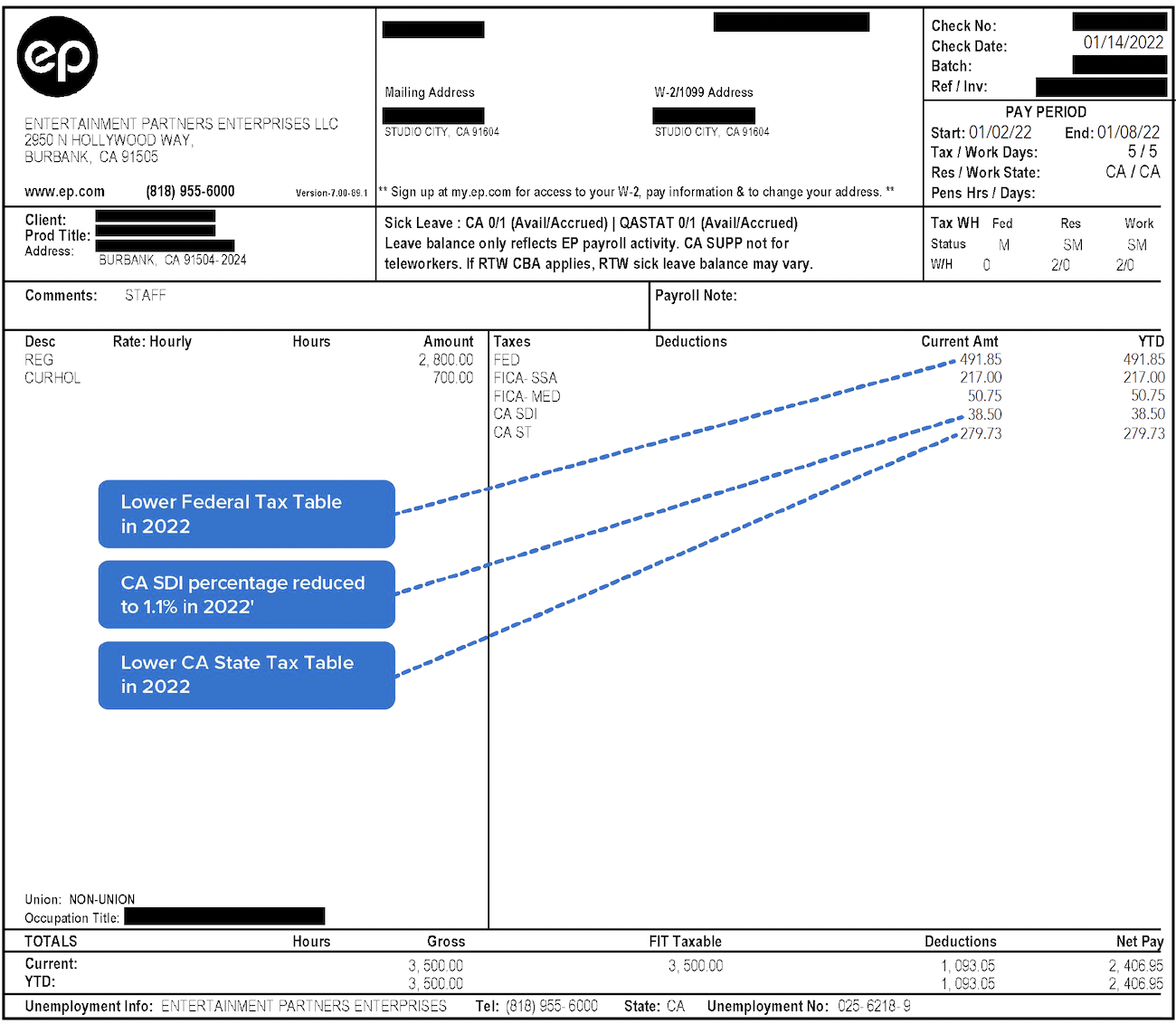

Decoding Your Paystub In 2022 Entertainment Partners

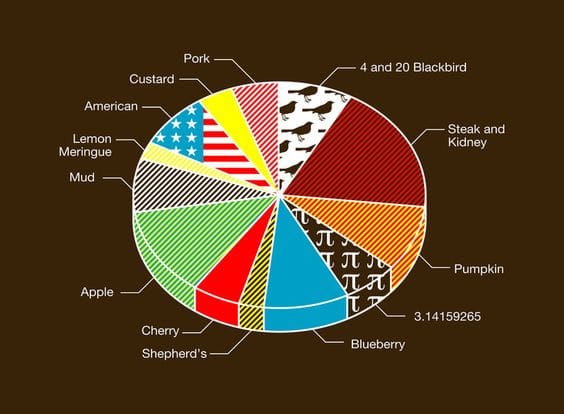

The Measure Of A Plan

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Paycheck Calculator Online For Per Pay Period Create W 4

Mathematics For Work And Everyday Life

Mathematics For Work And Everyday Life

Paycheck Taxes Federal State Local Withholding H R Block

The Measure Of A Plan

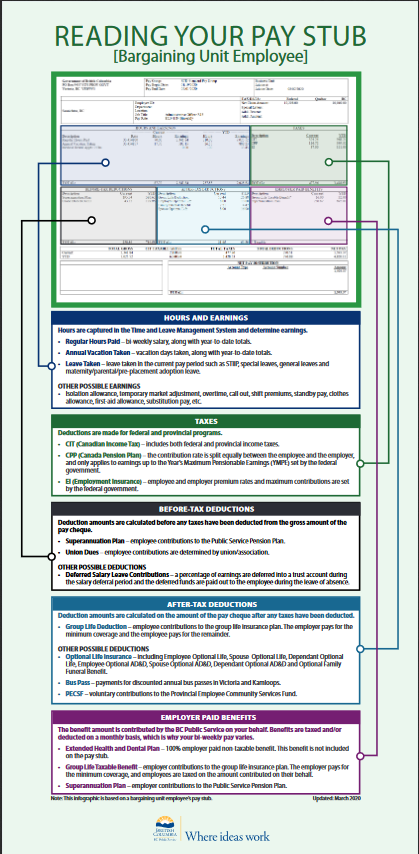

How To Read Your Pay Stub Province Of British Columbia

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Annual Compensation Vs Annual Salary

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

How To Calculate Payroll Tax Deductions Monster Ca

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Here S How Much Money You Take Home From A 75 000 Salary